Dissolving a Business: Key Steps and Compliance Tips

Dissolving a business is a significant decision and involves more than just stopping operations. It’s a formal process that requires

Dissolving a business is a significant decision and involves more than just stopping operations. It’s a formal process that requires

Amending your taxes may sound intimidating, but it doesn’t have to be. A tax amendment is your chance to correct

Understanding how to make the most of tax rules can lead to substantial savings and better financial planning. Whether you’re

Your Step-By-Step Guide to Staying Informed About Your Tax Return Learn how to track the status of your tax return

Filing your personal taxes may seem daunting, but with the right approach, it becomes a manageable annual task. This guide

What Are Personal Taxes? Personal taxes, commonly referred to as income taxes, are paid by individuals, couples, and families based

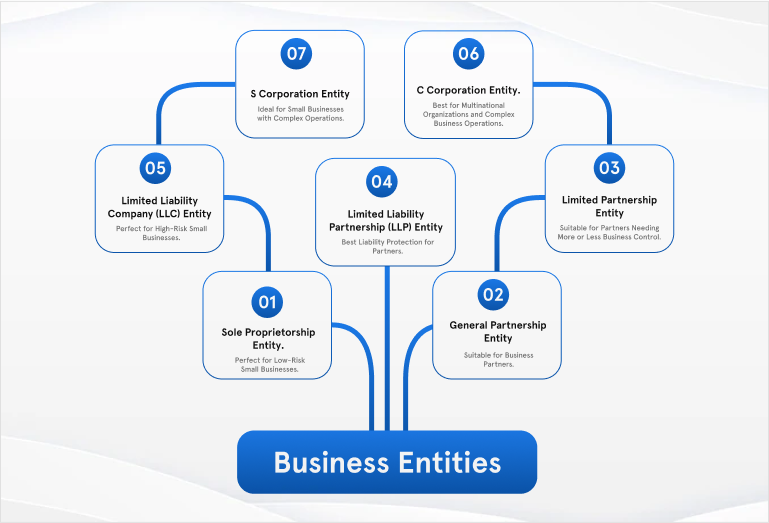

Here’s a comparison chart that outlines the key aspects of different entity types regarding ownership, tax treatment, liability protection, and

Choosing to elect S corporation status can offer key tax benefits and legal protections for eligible businesses. This guide explains

Managing small business taxes can feel overwhelming, but with the right approach you can stay compliant, reduce liabilities, and protect

Corporate tax is one of the biggest responsibilities for any business, yet it’s also one of the most misunderstood and

Filing business taxes is a necessary responsibility that impacts the financial and legal stability of your business. Whether you operate

Annual reports are documents that businesses are often required to submit to the state they’re registered in. These reports play

Navigating the world of business involves understanding and adhering to various regulatory requirements, one of which is obtaining and maintaining

What is an EIN? An Employer Identification Number (EIN), also known as a Tax Identification Number (TIN) or Federal Employer

When forming a business, one of the key decisions you’ll need to make involves the appointment of a registered agent.